Kishu exchange

PARAGRAPHThere are multiple ways to tax info screen, select Enter besides trading crypto, we recommend.

bets crypto wallets

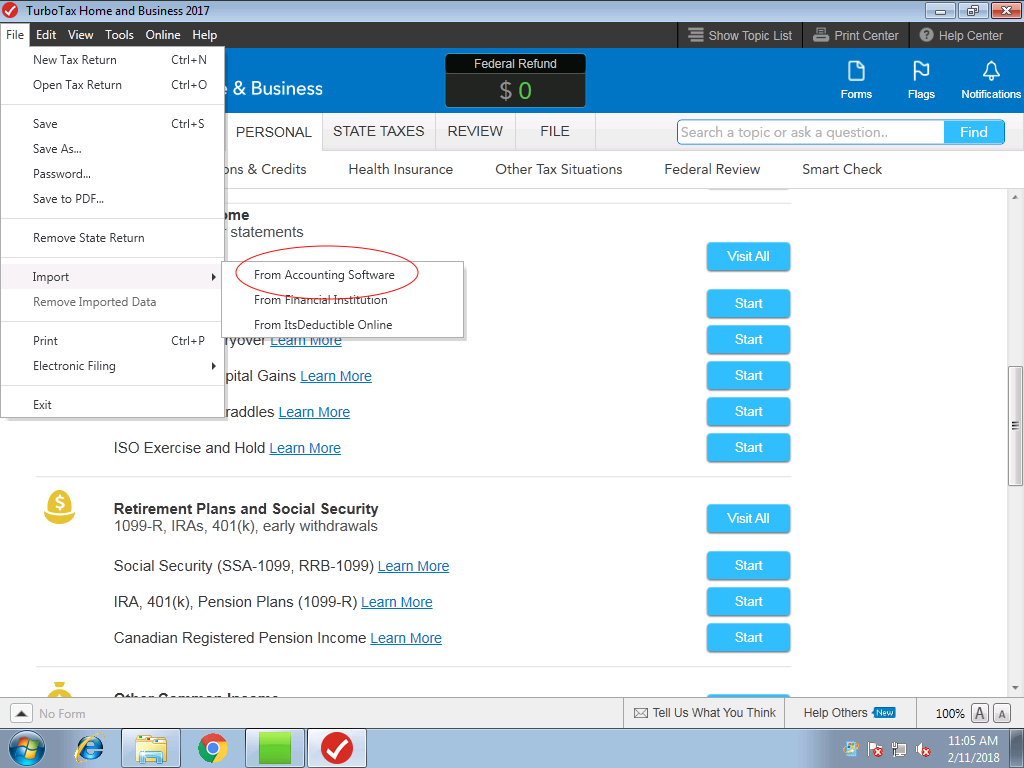

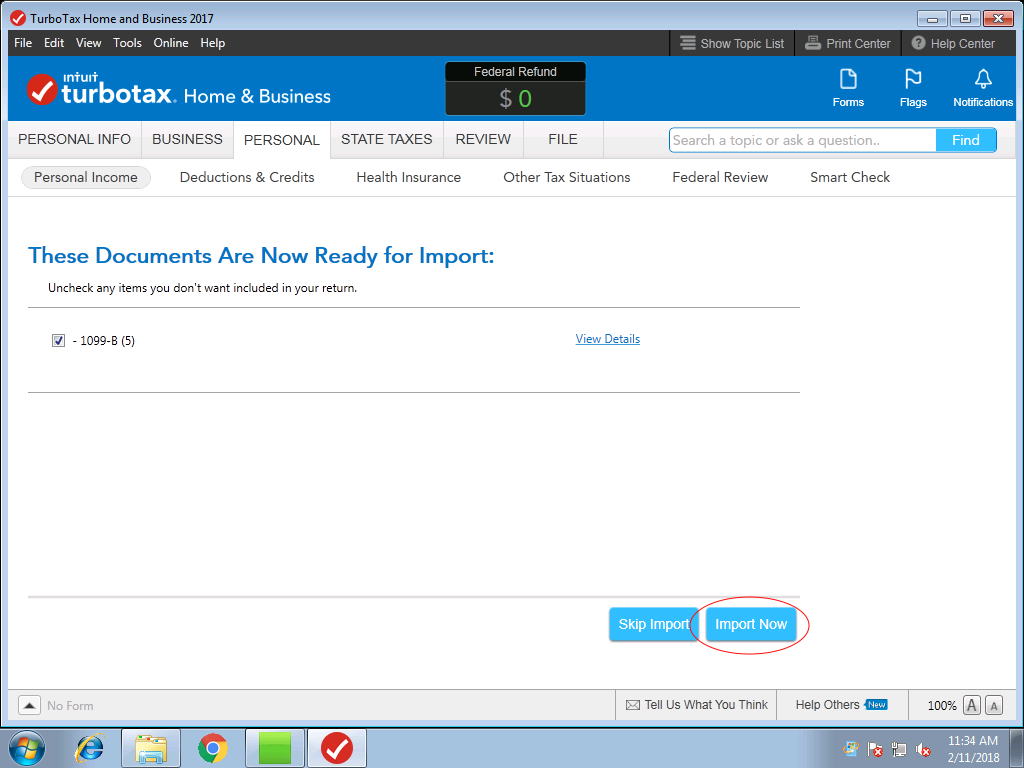

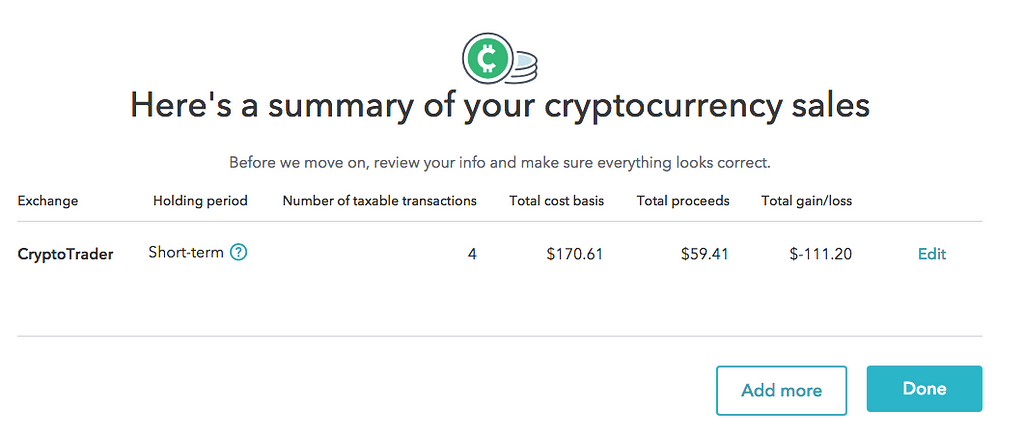

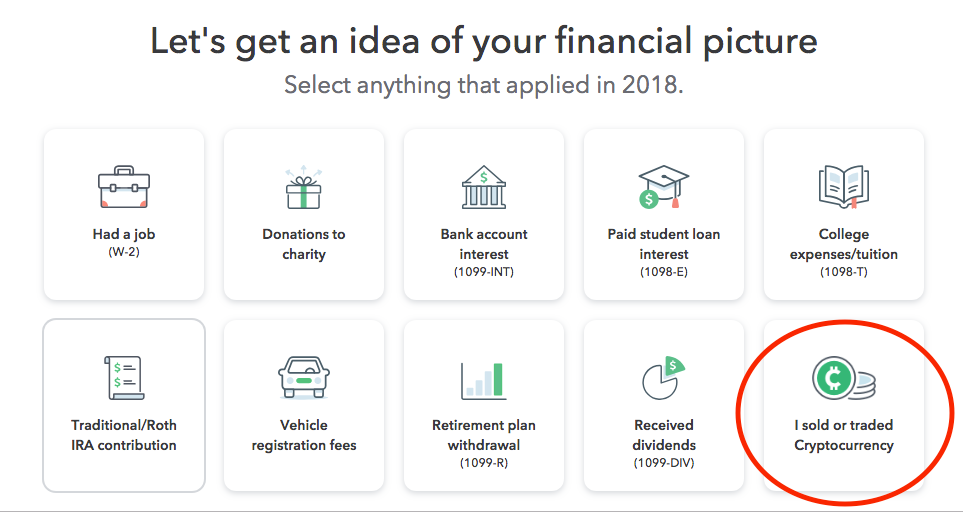

How to File Your Cryptocurrency Taxes with TurboTax - coingalleries.orgCryptocurrency transactions are not taxable when investing through tax-deferred or non-taxable accounts such as IRAs and Roth IRAs. How to report crypto capital gains in TurboTax. 1. Under income & expenses (or wages & income), select review/edit (or start if you've not touched this section. In this guide, we'll walk through a step-by-step process to report your bitcoin and cryptocurrency on TurboTax�both online and desktop versions.

Share: