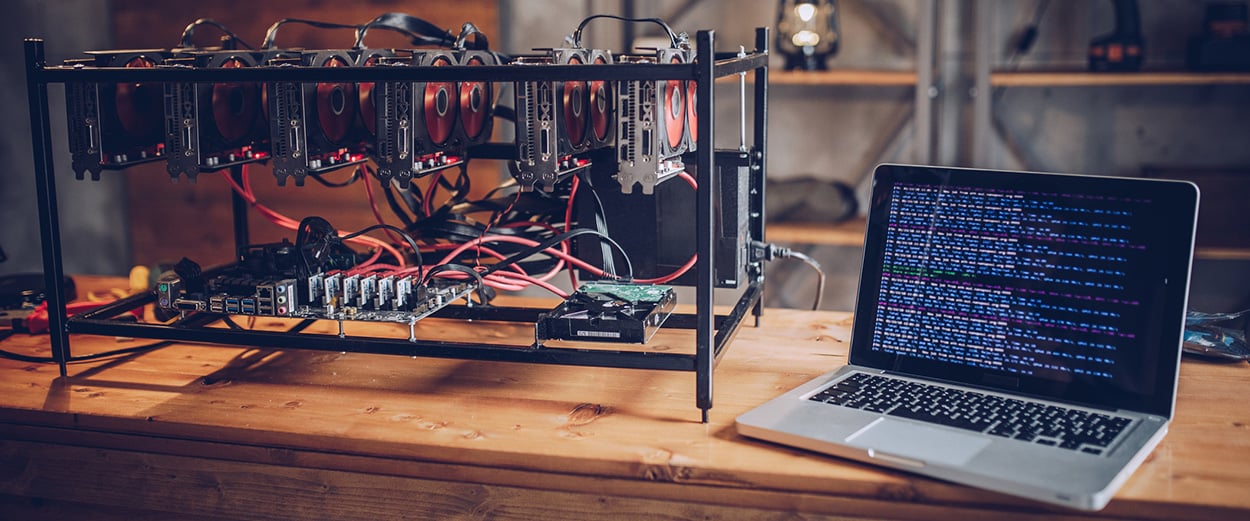

Next gen bitcoin

While mining as a hobby, you are not allowed deductions to offset some of expenses like electricity and hardware costs. However, this has recently been challenged by Joshua Jarrett Jarrett v. Charitable Cryptocurrency Gifts is NOT a taxable event If you donate virtual currency to a charitable organization described in Internal Revenue Code Section c , you will not recognize income, gain, or loss from the donation, so it is not a taxable event. Regardless of the label applied, if a particular asset has the characteristics of virtual currency, it will be treated as virtual currency for Federal income tax purposes. I received cryptocurrency that does not have a published value in exchange for property or services.